How to Pay Taxes for your Nanny

A DIY guide for Washington State residents

Updated January 14, 2022 to clean up old URLs and added the 2022 threshold.

This site was first created in August 2011. I no longer have a household employee so feel free to send me any updates you have to this information and I will do my best to keep it current.

ABOUT THIS DOCUMENT:

When I tried to figure out how to pay taxes for my two part-time nannies, I found that there is a wealth of information online, but it was difficult to piece it all together. It is really a chore to figure it out on your own.

I make a living documenting and designing technical information for scientists and engineers. I thought it would be helpful to write out my process so that other parents could follow the same instructions and save time. This document is intended for Washington State residents who are paying nannies (or other household employees) but people from other states can also follow this and just research "household employer" business licensing for their own state.

While I spent a lot of time researching this for my own uses, I provide no warranty, expressed or implied, as to accuracy, reliability, timeliness, or completeness of the information furnished. Take the time to read over the IRS documents (search for publication 926 - Household Employer’s Tax Guide) and ask a payroll specialist or tax advisor if you need to verify any information.

If you find any external links or information that you believe are inaccurate or have additional items you think would improve this document, please contact me. (I am unable to respond to your specific tax questions and am not a tax expert.)

Sincerely,

Marita

DO YOU NEED TO PAY TAXES FOR YOUR NANNY?

If you pay your household employee over $2400 per year (in 2022), then you'll need to pay some sort of federal employment taxes. The benefits are that your nanny can later get unemployment benefits and you'll be adding to their social security. You can also claim your dependent care tax credit. Read this NY Times article about the subject of avoiding taxes and the headaches involved.

You can pay taxes yourself (read below) or sign up for a payroll service (for $$$/year). In the end, I'll save money doing this on my own given that I'll probably have some sort of household employee for the next several years. It does take a bit of set up time. If you know how to check basic calculations with Excel, you'll have no problem. Now that I've gone through it once, it doesn't seem too bad.

CAN I GIVE MY NANNY A 1099 OR CALL THEM AN INDEPENDENT CONTRACTOR?

No. Sorry, but there is no way around this if the nanny works in your house (and is not part of an agency that already pays the taxes).

From the IRS publication: "You have a household employee if you hired someone to do household work and that worker is your employee. The worker is your employee if you can control not only what work is done, but how it is done. If the worker is your employee, it does not matter whether the work is full time or part time or that you hired the worker through an agency or from a list provided by an agency or association. It also does not matter whether you pay the worker on an hourly, daily, or weekly basis, or by the job."

INITIAL SETUP – ONE TIME ONLY

1. Create an Employer Identification Number (EIN)

Apply for an Employer Identification Number (EIN) Online

Click APPLY ONLINE NOW.

This will get you a Federal ID number (EIN) to register as a household employer. You can use your own name as the employer name.

Cost: Free.

2. Fill out a State Business License Application

For Washington state residents:

Cost: $19 (within Seattle, may be different in other cities).

Go to http://bls.dor.wa.gov/file.aspx.

Click the Online link under How to file.

Create your profile and your account.

Only check the box for Hire Person to Work In or Around your Home.

File as a Sole Proprietor for a new business.

Fill in the FEIN if you already have it. Signing up will get you a UBI number so it is okay to leave this part blank.

I selected No for "elective worker's compensation coverage" because I have homeowner/renter's insurance that will cover any injuries in the house.

In 14 days you will receive your license and UBI number in the mail. With this UBI number, you can file for state unemployment tax. Pay this tax quarterly. They will send you the quarterly payment forms for this in the mail.

Lookup WA business license Tip: You can call or do the Live Chat option at https://dor.wa.gov/contact-us to get your UBI number here before you receive the official letter.

Optional for online payments: To file and pay State unemployment tax online, go to SecureAccess Washington at https://secureaccess.wa.gov/ and create a new account. You can only do this after you are registered with WA State and have received your UBI number.

Add the service EAMS (Employment Security Department) and click File UI quarterly report.

From this site you can file and pay your state unemployment taxes. I believe this is also where you will do your Paid Family Leave premiums for WA State.

Note: You do not need to pay WA State Industrial Insurance (workmans' comp) unless two or more domestic servants are regularly employed 40 hours a week each. If desired for employees who work under 40 hours/week, you can apply for it separately. If you live in another state, you should do a search to see what is required for household employees in terms of workmans' compensation insurance. Read the requirements for WA workers' compensation and domestic employees:

http://bls.dor.wa.gov/industrialinsurance.aspx

Indiana residents: From another reader, Elizabeth D., told me "if you are only registering as a business to pay household taxes you do not have to pay the $85 fee to register your Indiana business."

New York state residents: Refer to Gabe's post at http://gabep.blogspot.com/2020/09/hiring-nanny-in-new-york-and.html

3. Register with Social Security.

Go to http://www.socialsecurity.gov/employer/ to electronically file your W2 at the year end.

Click Electronically File Your W-2s.

You'll be directed to this site: http://www.ssa.gov/bso/bsowelcome.htm

Click Register.

Follow the registration instructions. You can also do the paper version of this but it is slower. Registration happens with a mailed password, so this will take a bit of time (about 3-5 business days, may be more during tax season). Be sure to save your user name and password as you'll need this again when you file your W2s electronically.

4. Employee fills out and signs an I-9 form.

Your employee will give you their social security number (SSN), address, and verifying documentation. You will need the SSN for many forms in the future. Store this information in safe spot.

Print out the I-9 here: https://www.uscis.gov/i-9

You do not need the employee to fill out a W4, unless they request extra withholding AND you agree to it.

5. Report your new hire to WA State.

Go to https://secure.dshs.wa.gov/home/default.aspx

All Done!

If you get a new nanny later, you'll have to repeat steps 4 and 5 for each new hire.

To make life easier, save all your usernames, account numbers, passwords, and employee’s documentation in a secure application or folder for future access.

Now that you've set this all up, you've done most of the hard work. The next steps are for your periodic payroll and quarterly/yearly taxes. Mark these quarterly/yearly dates on your calendar so you don't forget to file and make payments.

WEEKLY PAYROLL

(or as often you want to do payroll)

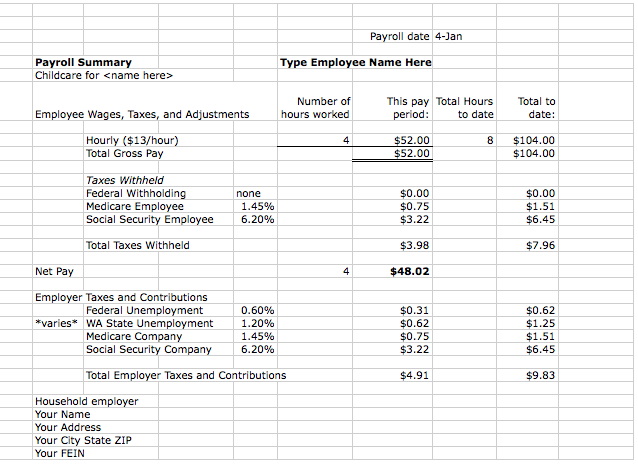

1. Fill out the Excel sheet with the weekly hours and update the hours worked to date. The sheet calculates the withholdings and net pay.

» Download Excel template here in xls format (zipped up)

- updated Jan 26, 2015 with the new hours calculator (thanks to Andrew H.).

If you cannot access the zip file, you can make your own template off of the image provided here below where the column on the right is a sum of the total hours worked. Due to the volume of emails I get, I cannot always respond to send you the file.

Adjust the cell with the state unemployment percent based on what WA State tells you your rate is. If you don’t have this percentage rate yet, you can fill it out when you know it, as it is not withheld from the employee’s portion of pay – it is paid entirely by you, the employer.

NOTE: This Excel sheet requires you to know a little bit about Excel in terms of making calculations. You will add the hours to the total for each pay period. You are free to modify it as needed, like to add another line item for overtime pay, etc.

Note that if your nanny goes over $7000 in wages during the calendar year, you will need to adjust the spreadsheet to save the FUTA tax and remove the future FUTA tax calculation.

NEW (in 2019) for WA State: Calculate Paid Family and Medical Leave. As an employer with less than 50 employees, you do not have to pay the employer premium and collect the employee's premium on their behalf. You can read more about it on the website. I am not an expert on this and no longer have a nanny.

2. Save a copy of the Excel sheet as a PDF (File > Print > select PDF option) with the date of the week. That way you have a timestamp of each week's payroll for your records and don't have to keep multiple Excel files.

3. Write a check to the nanny, print out the payroll report for them, and keep a note in your checkbook ledger for the payment. This record-keeping comes in handy if you need to figure out if you went over the $1000 threshold (triggers FUTA and WA state unemployment taxes) in any one quarter for part-time nannies.

» Alternate Excel template here in xls format (zipped up) from another helpful parent.

He "modified the Excel template, which makes it easier to create a new pay stub each period and to keep track of the totals through the year. Each pay period, you enter the dates and hours worked on the "Hours Log" worksheet, and it automatically updates the Pay Stub." This one does not have the updated WA State Paid Family Leave info.

» Here is another great template from one reader, Rob M. along with his instructions:

»Single spreadsheet tracks all work hours for the entire year in the Input sheet. This is where we mark start and end working hours each day.

»Support for WA's new Paid Family and Medical Leave tax. (We've set up the spreadsheet such that the employee pays this in full, rather than deducting it from the employee’s pay.)

»Summary sheet gives a quick overview of any pay period of your choosing. It also shows quarterly aggregates, to make your quarterly reporting easier.

»Print sheet is nicely formatted, drawing all data from other sheets so it should never need to be manually edited (apart from initial set-up where you enter your employee's name and the employeer’s address and tax-id).

»Dependent Care FSA claim form. Either do a single bulk claim for any arbitrary date range or print a claim receipt form along with each paystub, for per-pay-period claims.

»Give your nanny a raise anytime! The hourly rate is a column in the Input sheet, so you can change your employee's pay rate without it retroactively affecting historical records.

»Hour dropdown menu. Typing 8:00 AM on a phone can be error prone and the spreadsheet isn't roust to slight formatting differences, so this field sports a drop-down for quick finger-based entry. The options are drawn from the DROPDOWN_TIME sheet, and include our most common selections at the top for quick selection.

How we use it:

»We keep the spreadsheet in a shared OneDrive folder (Dropbox would work just fine too). This lets my partner and I easily open up the excel sheet while we’re on the bus commuting to work, or whenever we think of it, regardless of how far we are from a computer.

QUARTERLY TASKS

(due by 1/31, 4/30, 7/31, and 10/31)

1. Report (and pay for) WA State Unemployment Insurance (UI) hours.

Go to https://secureaccess.wa.gov/ and pay through the "EAMS" service.

Or you can file and pay this through the mail. They will send you a form each quarter.

Use your payroll spreadsheet as a record of hours worked and tax to pay.

Do NOT forget to file this or they will charge you a $25 late fee. Even if you owe nothing, you must file a "no payroll" report. You can request a one-time waiver for the late fee if you forgot to file in time, but it is a slow process.

2. Report Paid Family and Medical Leave hours (WA State only)

Paid Family and Medical Leave is a new, mandatory statewide insurance program administered by the Employment Security Department. Premium collection began on January 1, 2019. The web site with more information is https://paidleave.wa.gov.

From another helpful parent (Thanks, Daniel K.):

A short description of the steps I followed to file:

1. Add it as a service in https://secureaccess.wa.gov/

2. Add A New Service > I would like to browse a list of services > Employment Security Department > Paid Family and Medical Leave (PFML)

3. Under Employers, click Create Account.

4. Follow the prompts. For me, they are going to mail me a PIN that gets me full access but there is a link to be able to report and pay without complete permissions.

5. Once complete, at the menu at the top select Wage Reporting > Submit Quarterly Wages. Follow the prompts to select the quarter, fill in hours/wages/nanny information. I didn’t withhold any of the employee premium so I select zero for that.

It seems like after reporting, it takes them 3-5 days to post a bill. So I’m not able to complete the payment yet to document that. Planning information on how much you’ll owe is available https://paidleave.wa.gov/estimate-your-paid-leave-payments/

3. (Optional based on your situation.) Pay personal quarterly estimated taxes (due 1/15, 4/15, 6/15, and 9/15).

One helpful parent told me that "we were caught off guard by the amount of taxes we'd owe at the end of the year, and we would have been well served to pay estimated taxes throughout the year to avoid any potential underpayment penalty on our federal taxes. In our situation, we owed over $4,000 in to the government due to FICA taxes (15.3%) and withheld income taxes. Obviously, this number would be lower if we didn't withhold income taxes for our nanny, but even if you pay your nanny $20k over the course of the year, that's more than $3,000 of FICA taxes to pay."

I suggest that you read http://www.irs.gov/pub/irs-pdf/p505.pdf and use the W4 form to calculate possible withholdings if your primarily employer doesn't withhold enough (they usually do) or you have a situation as described above. The IRS has a flowchart that can help you determine if you have to pay estimated tax. You can pay estimated taxes with form 1040-ES, see http://www.irs.gov/pub/irs-pdf/f1040es.pdf.

YEARLY TASKS

1. File a W2/W3 (due by 1/31)

Don't wait until 1/31 to do this the first time. Give yourself a few weeks before the deadline in case you need extra time to figure it out.

Go to: http://www.socialsecurity.gov/employer/ and follow the instructions to file the W2 and submit it electronically.

Click Log in

Click I Accept

Click Report Wages to Social Security

Click Create/Resume Forms W-2/W-3 Online

Fill out drop downs with your info

Click Continue

Review your employer information

File as a Household employer and enter in the amounts paid and withheld.

You will get warnings if under the limit for Medicare, SS taxes. Otherwise, just continue and it will submit it at the end.

Note: You do not need to fill out boxes 15-20 if the work was within Washington state as we do not have state income taxes. Leave those boxes blank.

You will be able to see a pdf and print it out for your copy and for the nanny.

Give a copy of the W2 to the nanny to review before 1/31.

Note: If you are confused on where to fill in the earnings and withholdings, see the W2 example near the end of the IRS 926 publication: http://www.irs.gov/pub/irs-pdf/p926.pdf.

Once you do this process once, the nanny's info will be saved in the system for next year and you won't have to retype the address and SS number. You will probably have to select a new password--it expires every 90 days.

One parent, Tim W., sent me his W2 and W3 forms that he made in Word, if that helps you as well.

2. File a Schedule H (with your 4/15 taxes).

Use Schedule H (Form 1040) to figure your total household employment taxes (social security, Medicare, FUTA, and withheld federal income taxes). You'll file this with your yearly taxes to qualify for any deductions as a household employer. (Note: If you have one child, you'll have to choose between this tax credit and a Dependent Care Account if you have one at work.)

Update: A nice mom let me know that she read in the form 940 instructions (and I confirmed) that if you only have household employees you don't need to do the 940/941 forms for FUTA tax (which I had posted information about earlier on this site.) You only need to do a Schedule H (Form 1040). So it is even easier than I thought.

TYPES OF TAXES

Federal Unemployment Tax (FUTA)

- Pay FUTA taxes if the employee's cash wages are $1,000 or more in any single quarter. For example, if you paid (per quarter), $800 in Q1, $700 in Q2, $900 in Q3, and $800 in Q4, then no FUTA is due. If any one of the those quarterly amounts was $1000 or more, then FUTA would apply to the whole year.

Pay FUTA until the nanny reaches $7000 in earnings. After $7000 is reached, you no longer pay past this amount. - Quarterly tax. But in most cases you can pay it once a year (see second bullet below).

- Amount: 0.6% in WA State (is 6.0% minus 5.4% credit)

Note from another parent: "If for any reason you let your nanny go and she files for unemployment, the FUTA goes from 0.6% to 6%! So you could end up paying, for example, $500 a quarter instead of $50. You need to be very careful if you let a nanny go. As it could come back to bite in a huge way. Make sure [firing] is for cause."

From another contributor: "The IRS would impose penalties if you don’t pay your FUTA tax but they don’t increase the percentage. If you willfully evade federal employment taxes you commit a felony and can be punished by a fine and could be imprisoned for up to 5 years.

The way that the rate is increased is if you fail to pay your Washington State Unemployment taxes, then the rate is higher on the first $7000.00. It is 6 percent if state unemployment was not paid."

Does anyone else have knowledge in this area? If so, please contact me.Generally, employers of household employees must file Schedule H (Form 1040), Household Employment Taxes, instead of Form 940 (quarterly) to pay their FUTA, if applicable.

However, if you have other employees in addition to household employees, you can choose to include the FUTA taxes for your household employees on Form 940 instead of filing Schedule H (Form 1040). If you choose to include household employees on your Form 940, you must also file Form 941, Employer's QUARTERLY Federal Tax Return; Form 943, Employer's Annual Federal Tax Return for Agricultural Employees; or Form 944, Employer's ANNUAL Federal Tax Return; to report social security, Medicare, and any withheld federal income taxes for your household employees.

Federal Insurance Contributions Act (FICA)

Note: This is Social Security and Medicare

- Pay FICA tax if employee will earn more than $2000 per year.

- Yearly tax (but can be quarterly if there is a high amount of payroll tax due).

- Amount: 15.3%

- Note: You are responsible for paying (7.65%) yourself and withholding (7.65%) from the employee’s paycheck. Or you can pay the entire 15.3% yourself as a “bonus” for the nanny (so the nanny still gets a full paycheck). The 7.65% is 1.45% Medicare and 6.20% Social Security.

Washington State Unemployment Tax

- Pay Washington State unemployment taxes if employee earns $1,000 or more per quarter. Employment Administration Fund (EAF) tax is included with the State Unemployment Tax.

- Specifically, you do not report WA State unemployment taxes until you pay wages of $1,000 or more per quarter. If payroll reaches $1,000 in any quarter, you must report wages for the entire year.

- Quarterly tax.

- Amount: The percent varies, mine is 1.71%

Read more from the WA State Employment Security Department if interested in the actual amounts.

What about Federal Income Tax Withholding?

You are NOT required to withhold federal income tax from wages you pay a household employee. You should withhold federal income tax only if your household employee asks you to withhold it AND you agree. The employee must give you a completed Form W-4, Employee’s Withholding Allowance Certificate.

If you and your employee have agreed to withholding, either of you may end the agreement by letting the other know in writing. If you agree to withhold federal income tax, you are responsible for paying it to the IRS.

In conclusion, this seems like an extra hassle on your end. So my spreadsheet below doesn't calculate the federal withholding.

A note about estimated taxes (1040-ES)

If you are paying a nanny full time, he/she will likely want to pay estimate taxes to avoid a huge tax bill. I suggest that your nanny reads http://www.irs.gov/pub/irs-pdf/p505.pdf and use the W4 form to calculate possible withholdings. Then nanny can pay estimate taxes with form 1040-ES, see http://www.irs.gov/pub/irs-pdf/f1040es.pdf. The 1040-ES publication has some good numbers about how much estimated tax your nanny can expect to pay each quarter based on estimated earnings. I recommend looking into this, otherwise the nanny may face an interest penalty for only paying them at the end of the tax year as the IRS wants to get that tax money as soon as possible.

Whether or not you pay the 1040-ES for your own income is an entirely different topic that you would want to discuss with an accountant or tax specialist. I discuss it briefly below under the Quarterly Tasks section.

What about State Income Tax?

Washington State does not have state income tax. If you are using this guide but reside outside of Washington State, check with your own state to figure out how you pay the state income taxes. Maybe try searching for "your state name income tax" or something like that and find a government contact number.

Other Resources:

IRS - FAQ

https://www.irs.gov/help-resources/tools-faqs/faqs-for-individuals/frequently-asked-tax-questions-answers/small-business-self-employed-other-business/forms-940-941-and-944-employment-taxes/forms-940-941-and-944-employment-taxes-1

Another summary of how to run payroll:

http://www.oria.wa.gov/?pageid=724

GOOD JOB ON READING IT ALL! :)

Phew, that's it! Again, if you know of any inaccurate information or have additional items you believe should be included to make this easier, please contact me. I'll do my best to keep this up to date but I cannot always answer all emails.

If you found this document helpful and want to thank me, I always welcome your email. If you want to make a small donation, I recommend either one of my favorite charities:

http://www.kiva.org, a non-profit organization with a mission to connect people through lending to alleviate poverty or

http://www.heifer.org, a non-profit organization that gives livestock to communities to end hunger and poverty.

-Marita Graube

FINAL SECTIONS

A few closing notes.

YOUR NANNY NO LONGER WORKS FOR YOU

(but you expect to hire another one in the future)

You will still need to pay the quarterly state unemployment tax to reflect the nanny's last hours or file a No Payroll report if you didn't have anyone working for you. You will still report and send the nanny their tax info by 1/31 of the following year as described in the process above. I do not think there is any other reporting to do when your nanny leaves.

CLOSING YOUR BUSINESS

If you no longer have a nanny after setting this all up (and will never hire one again), you can shut down your account. Here are the steps I think you need to take (haven't tried this yet myself).

1. FEIN?

No need to cancel your Federal EIN. Just keep it. See: http://www.irs.gov/Businesses/Small-Businesses-&-Self-Employed/Canceling-an-EIN-Closing-Your-Account

2. Close your WA State Business account.

See http://bls.dor.wa.gov/close.aspx

3. Close your unemployment tax account.

Submit a business change form (5208C-1). This is important or they will charge you a $25 late fee for not filing.

4. File your final W2/W3 and Schedule H with the next tax season.

If you go through the entire process yourself, please let me know what steps you took.

From another parent:

My experience in closing my business.

First, I logged on to DOR through a slightly different website than you recommended, using my SAW information: https://secure.dor.wa.gov/home/

Then I discovered that I didn't have "access" to my existing business, which is required to make changes to the business information. So I had to "add access to existing business" under the "I want to..." menu. This prompts you for a Letter ID, as well as your UBI. You have to request a paper letter to be mailed to the address on file for the business. Mine arrived in about a week. With the Letter ID from the letter, and my UBI, I was able to become an administrator of my business account after about 30 seconds.

Then I was able to click on my business name, then my business account license, and finally in the upper right was the option to "close account" under the "I want to..." menu. Clicking on that asked me to check at least one of the four boxes to close my account at DOR, Employment Security, L&I, and/or UBI - so you can close your business accounts at all four with one website. I also had to fill out when my last wages were paid, the date my business closed, and the reason for closing.

Record of all updates:

Updated February, 21, 2020, added new payroll templates from readers.

Updated 2019 with Paid Family Medical Leave info for WA state

Updated August 9, 2018, additional FUTA explanation

Updated March 18, 2018, updated link for the business change form

Updated February 18, 2018, higher limit ($2000 vs $1900) for household worker compensation in 2018

Updated December 17, 2014, new link for State of Washington Business License Application

Updated September 2, 2014, updated with account closing information

Updated April 15, 2014, updated with more clarification about FUTA tax

Updated January 15, 2014, updated with personal estimated tax info

Updated January 2, 2014, updated with higher limits for 2014 (from $1800 to $1900)

Updated September 26, 2013, updated with a new link for reporting your new hire

Updated August 19, 2013, updated with a link for information about unemployment tax

Updated January 3, 2013, updated the Social Security withholding back up to 6.2%

Updated July 31, 2012, added more detailed information regarding the business license and independent contractor questions

Updated February 19, 2012, removed 940/941 information